In the pulsating world of SocialFi on Base, where decentralized communities thrive amid blockchain’s economic cycles, Sysfi stands out as a bold no-code DAO aggregator tailored for 2025. This platform promises to slash barriers for creators building SocialFi DAOs and DACs, letting anyone spin up on-chain governance in seconds without touching a line of code. As Base Protocol hovers at $0.2197, reflecting a subtle 24-hour dip of -0.0190%, the timing feels pivotal; low-gas efficiency on Base positions it perfectly for mass adoption in community-driven finance.

Sysfi arrives at a crossroads for decentralized social networks. Traditional DAO tools demand developer savvy, stifling non-technical SocialFi enthusiasts eager to launch token-gated groups or reward systems. Sysfi flips this script, targeting the Base ecosystem’s surge in user-owned platforms like Farcaster frames and warpcast channels. Its aggregator model centralizes discovery and management, potentially becoming the hub for SocialFi DAOs on Base.

Sysfi’s No-Code Revolution for SocialFi Builders

Picture launching a full DAO; governance proposals, staking pools, and custom tokens; all in under 60 seconds. Sysfi’s interface delivers exactly that, powered by $SYN and Alpha NFTs. No longer do SocialFi communities need smart contract wizards; drag-and-drop modules handle deployment on Base’s Layer 2 rails. This aligns with broader economic shifts, where accessibility drives network effects in crypto social layers.

Building the largest DAO/DAC Aggregator on Base. Run your DAO in 60sec with No-Code.

Context matters here. Base’s $0.2197 price underscores cost predictability for these operations, unlike volatile L1s. Sysfi’s dual governance; blending token voting with NFT-weighted decisions; caters to hybrid SocialFi models, where influencers hold sway via holdings. Early X buzz from TRN Technologies echoes this, praising the frictionless setup for DACs, or decentralized autonomous communities, ideal for niche SocialFi tribes.

Unpacking Sysfi’s DeFi and Launchpad Arsenal

Beyond basics, Sysfi weaves in comprehensive DeFi primitives. Users provision liquidity for DEX trades, tap lending pools via smart contracts, and bridge assets multi-chain; all no-code. This turns SocialFi DAOs on Base into self-sustaining economies, rewarding engagement with yields. The launchpad feature elevates it further, incubating Web3 projects through community-voted IDOs and IEOs. Fair launches on Base minimize frontrunning, a boon amid regulatory whispers like CFTC’s spot crypto oversight.

Token factories shine brightest. Launch governance-enabled tokens with bespoke tokenomics; supply caps, vesting, burns; cross-chain if needed. For SocialFi, this means instant community coins for airdrops or loyalty points, fueling viral loops. Yet, whitepaper details hint at Systematic Finance roots, blending no-code with robust security; audited contracts assumed, though transparency lags per community chatter.

Sysfi (SYN) Price Prediction 2026-2031

Forecasts starting from presale price of $0.022, factoring in Base SocialFi adoption, project risks, and market cycles

| Year | Minimum Price ($) | Average Price ($) | Maximum Price ($) | Est. Avg YoY % |

|---|---|---|---|---|

| 2026 | $0.010 | $0.040 | $0.120 | +82% |

| 2027 | $0.015 | $0.080 | $0.250 | +100% |

| 2028 | $0.025 | $0.150 | $0.500 | +88% |

| 2029 | $0.040 | $0.280 | $1.000 | +87% |

| 2030 | $0.060 | $0.500 | $2.000 | +79% |

| 2031 | $0.100 | $0.900 | $4.000 | +80% |

Price Prediction Summary

$SYN has high-risk, high-reward potential driven by Sysfi’s no-code DAO tools for SocialFi on Base. Average prices project moderate growth from $0.04 in 2026 to $0.90 by 2031, assuming platform adoption amid crypto bull cycles. Minimums account for bearish scenarios like low traction or regulatory hurdles; maximums reflect bullish adoption and Base ecosystem expansion. From presale $0.022, potential ROI up to 18,000% by 2031 max.

Key Factors Affecting Sysfi Price

- Rapid adoption of no-code DAOs in SocialFi communities on Base

- Base blockchain growth and Coinbase ecosystem synergies

- Presale momentum recovery and token utility realization (governance, staking, launchpad)

- Crypto market cycles, with bull runs amplifying altcoin gains

- Regulatory clarity for DAOs/DeFi vs. potential crackdowns

- Competition from established tools like Aragon, but no-code edge

- Technological enhancements and multi-chain DeFi integrations

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Presale Realities and Community Pulse in 2025

Sysfi’s $SYN presale kicked off November 1,2025, with tiers starting at $0.022. Ambition met reality; it raised just 0.1 ETH, sparking skepticism. YouTube reviews from Savage and Drex Solan label it speculative; not scam outright, but credibility unproven. Delays and pivots fuel doubts, contrasting hype around no-code DAO aggregators on Base.

Still, for SocialFi DAOs on Base, the vision persists. At Base’s steady $0.2197, transaction thrift supports experimentation. Communities weigh dual governance and staking rewards against execution risks. My take; in economic cycles favoring decentralization, Sysfi could catalyze if it bridges communication gaps. Early adopters eye testnet for sysfi testnet socialfi trials, positioning as base DAC aggregator 2025 leader.

Feedback loops from X and reviews reveal hunger for such tools, tempered by presale stumbles. Sysfi’s no-code ethos democratizes power, but success hinges on delivery amid Base’s maturing SocialFi scene.

Navigating these hurdles requires a sharp eye on execution. Sysfi’s promise as a no code DAO aggregator base hinges on testnet rollouts, where sysfi testnet socialfi experiments could prove its mettle for real-world SocialFi DAOs on Base. Developers and communities testing DAC setups report smooth governance flows, but scaling to mainnet demands flawless audits and liquidity bootstraps.

Zoom out to macroeconomic tides, and Sysfi slots into a favorable window. Base’s $0.2197 stability amid minor dips signals investor confidence in Layer 2 SocialFi infrastructure. As decentralized networks mature, tools lowering entry barriers amplify virality; think Farcaster collectives minting instant tokens for member perks. Sysfi’s aggregator could index thousands of socialfi daos on base, fostering cross-DAO collaborations via shared staking pools.

Risks Tempering the Hype Around Sysfi

Skepticism isn’t unfounded. The presale’s meager 0.1 ETH haul underscores traction gaps, echoing patterns in early-stage Base projects where hype outpaces delivery. Community voices on X highlight pivots from initial roadmaps, eroding trust. In a cycle where capital flows to proven yields, unvetted no-code platforms risk rug-pull perceptions, even if whitepaper blueprints tout secure token factories.

Regulatory shadows add layers. CFTC’s push into spot crypto markets could scrutinize launchpads, demanding KYC for IDOs that clash with DAO anonymity. Sysfi must balance innovation with compliance, lest it alienate risk-averse SocialFi builders. My read: at this juncture, allocate curiosity over capital; monitor $SYN vesting unlocks for alignment signals.

Sysfi Pros & Cons 2025

-

No-Code Speed: Create DAOs and DACs in under 60 seconds via intuitive interface, empowering non-technical SocialFi users. (Whitepaper)

-

DeFi Integrations: Seamless liquidity pools, lending/borrowing, and multi-chain support for efficient asset management on Base.

-

Launchpad Fairness: Community-voted IDOs/IEOs with decentralized fundraising, ensuring transparent project incubation.

-

Presale Underperformance: $SYN presale raised only 0.1 ETH, signaling low initial traction and viability concerns.

-

Transparency Issues: Community flags delays, plan changes, and poor communication, eroding trust.

-

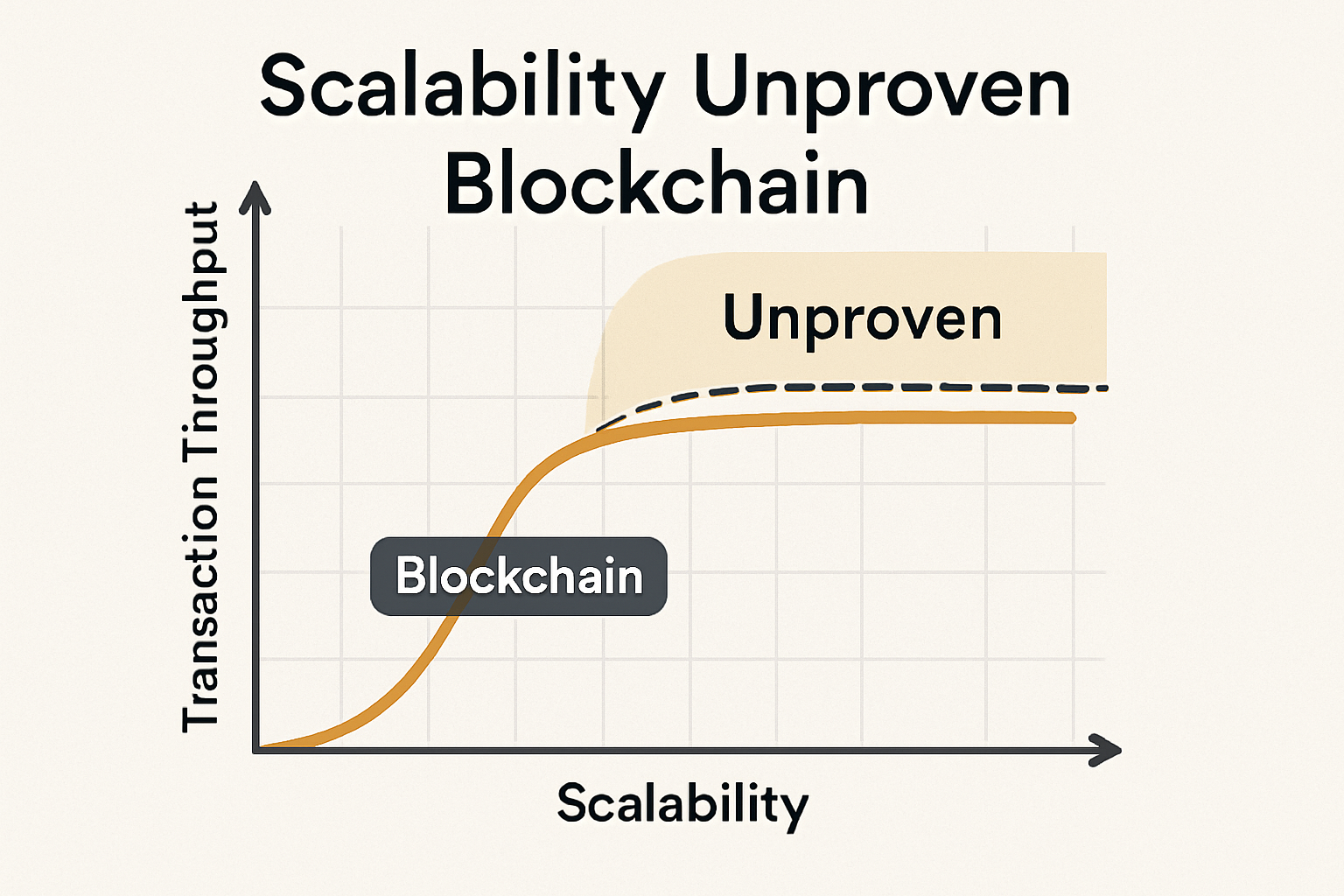

Unproven Scalability: Speculative platform lacks real-world stress tests despite Base’s efficiency ($0.2197).

Charting a Path Forward for SocialFi Pioneers

For those undeterred, Sysfi offers tactical edges in 2025’s SocialFi arena. Start small: deploy a DAC for your Farcaster frame community, layer in staking for engagement bounties, then pitch it via the launchpad. Base’s low fees at $0.2197 keep iterations cheap, turning prototypes into live economies. Dual governance shines here, letting NFT alphas steer while tokens democratize votes; a nod to merit-based hierarchies in flat crypto orgs.

Pair this with broader Base momentum. As SocialFi eclipses Web2 silos, aggregators like Sysfi could command network value, indexing DAOs by TVL or activity. Yet context reigns: pair presale tiers from $0.022 with real utility metrics before diving in. Economic cycles favor builders who iterate publicly, so Sysfi’s transparency pivot will define its arc.

Ultimately, Sysfi embodies the tension in decentralized social finance: audacious accessibility versus proven resilience. In Base’s ecosystem, where $0.2197 anchors efficient scaling, it holds potential to unify fragmented socialfi daos on base. Watch testnets closely, engage communities critically, and let data dictate entry. This no-code wave could redefine community power, provided founders match vision with velocity.