In the rapidly evolving landscape of SocialFi on the Base blockchain, few projects have generated as much curiosity as the so-called “Charm App. ” Despite a surge in interest and scattered references across crypto forums and aggregator sites, as of October 20,2025, there is no publicly available information confirming a live SocialFi-DeFi integration called Charm App on Base with a $CHARM token. This review unpacks what’s known, what’s speculative, and why the intersection of SocialFi and DeFi on Base continues to attract builders and users alike.

SocialFi on Base Blockchain: The Bigger Picture

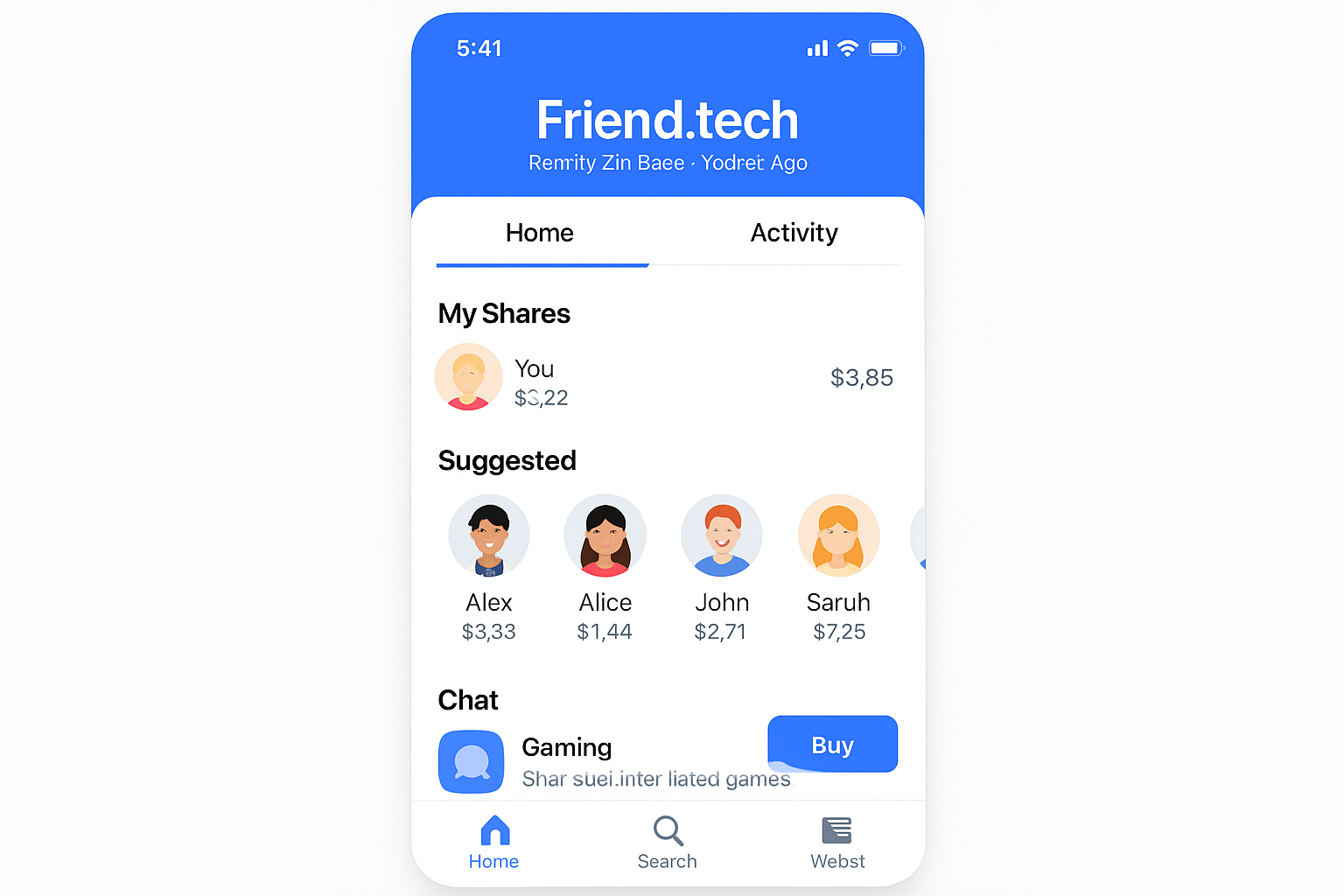

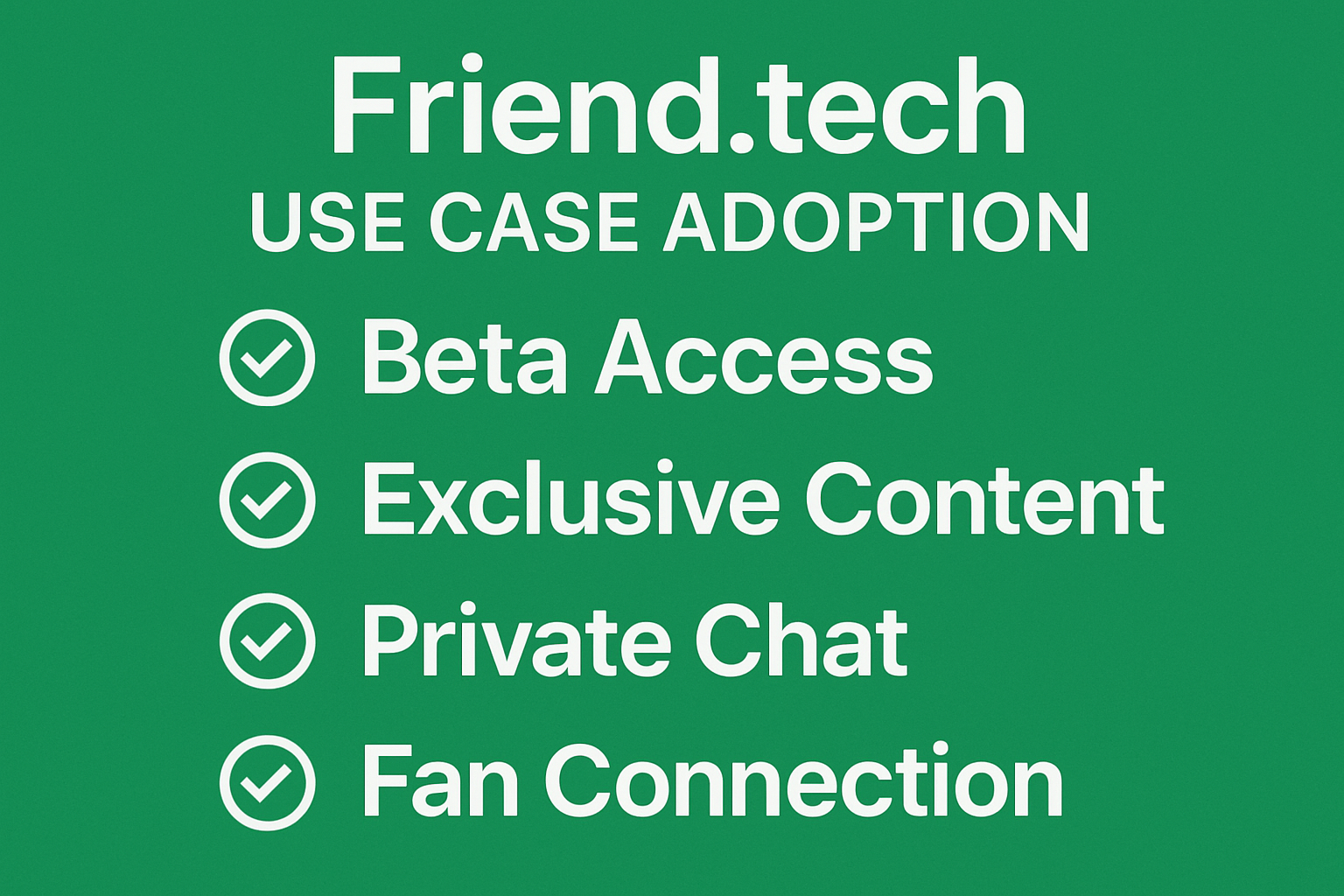

The Base blockchain has quickly become a hub for decentralized social crypto apps. Flagship platforms like Friend. tech and Farcaster are leading this charge by transforming traditional online interactions into tokenized economies. Users are no longer just creators or consumers, they’re stakeholders, earning rewards for engagement and creativity. NFT Evening’s deep dive highlights how DEGEN tokens and Zora are further catalyzing this shift by making content creation both accessible and potentially lucrative.

This context is crucial when evaluating any new entrant in the space, including Charm App. The appetite for apps that blend community engagement with financial incentives is clear. The question is whether Charm delivers something unique or merely rides the coattails of its predecessors.

What Is (and Isn’t) Known About Charm App

Crypto circles reference several projects named “Charm, ” but none are confirmed as a SocialFi-DeFi hybrid app on Base using a $CHARM token. Instead, we find:

- Charm AI: An AI-driven content platform leveraging a $CHRM token for democratized creation (not tied to Base SocialFi).

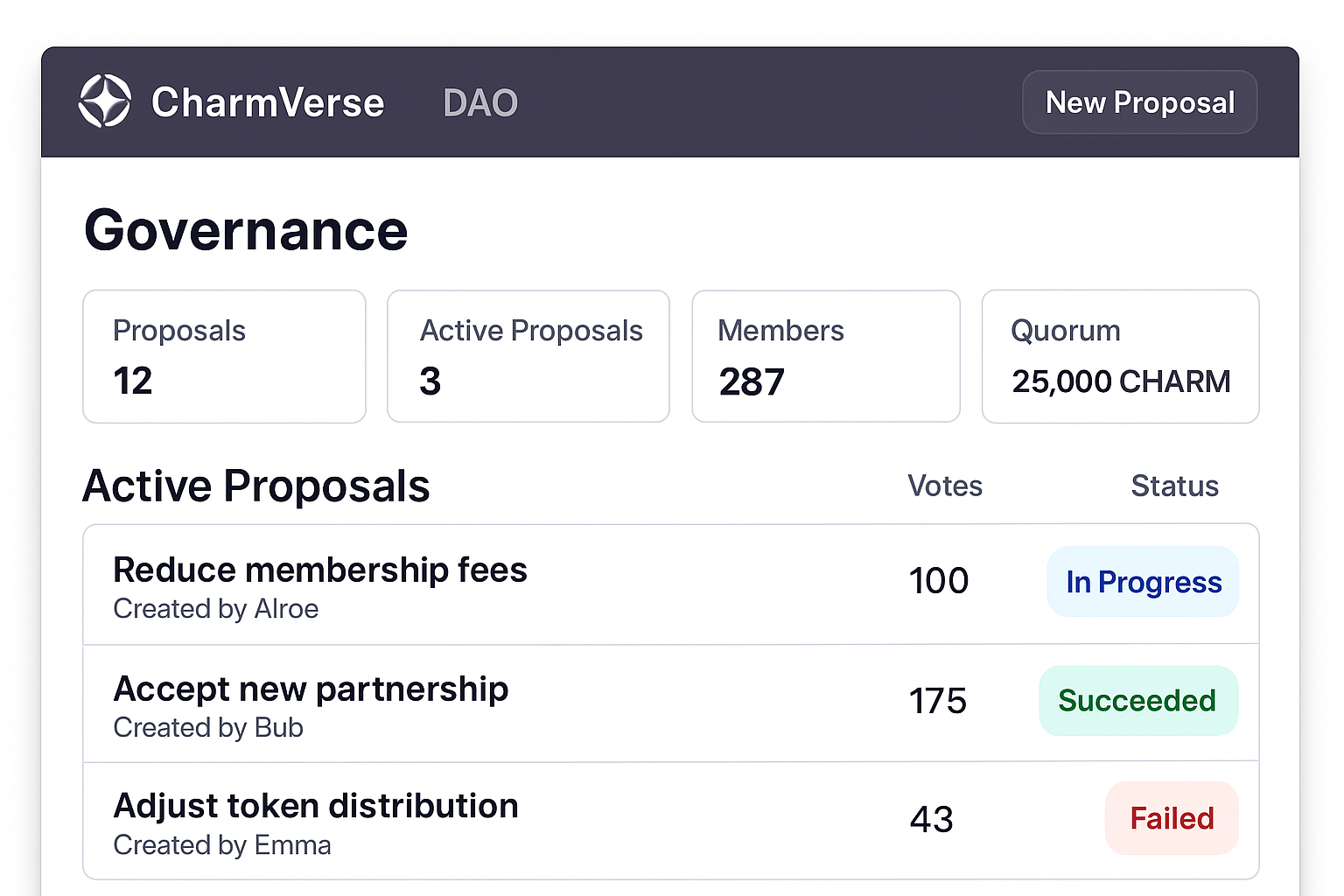

- CharmVerse: A DAO tooling suite focused on community management, role-gating via tokens/NFTs, and bounty rewards, useful for DAOs but not inherently SocialFi.

- Charm AMM: An innovative automated market maker enabling liquid options trading on-chain; DeFi-centric but not social-focused.

No major crypto price aggregators list a $CHARM token related to Base or any verifiable SocialFi-DeFi protocol. This lack of clarity suggests either an early-stage stealth launch or confusion with similarly-named projects across other chains.

The Allure of Merging SocialFi and DeFi: Why It Matters

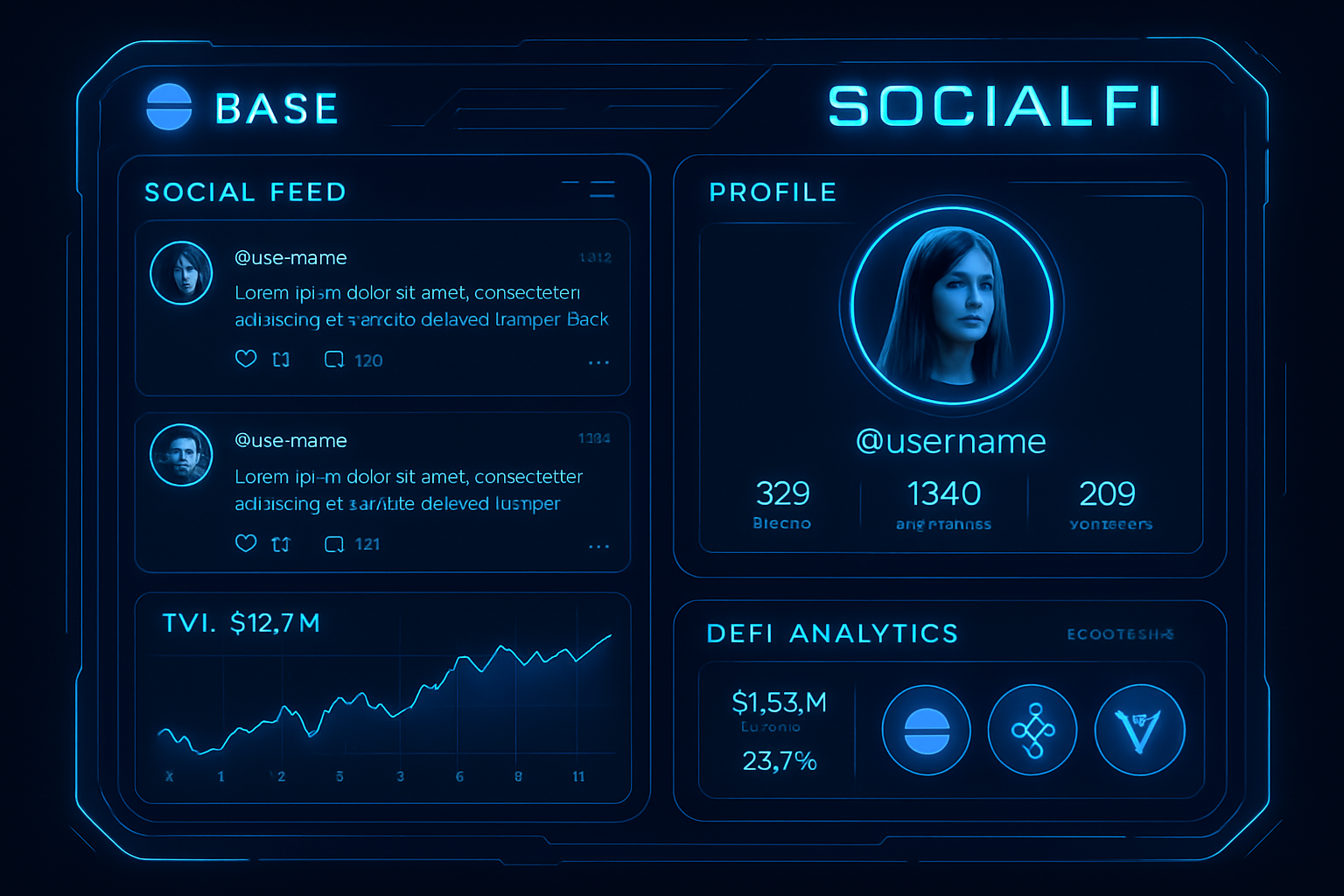

The concept behind apps like Charm is compelling: imagine earning yield or governance rights simply by participating in social networks. On platforms like Farcaster or Friend. tech, users already monetize their attention via creator coins and tradable content. Extending this model to include automated market making or options (as seen in some DeFi protocols) could unlock even deeper engagement loops, but only if executed transparently with robust tokenomics.

Essential Features of Next-Gen SocialFi-DeFi Apps

-

Seamless Integration of Social and Financial Tools: Platforms like Friend.tech and Warpcast on Base allow users to monetize social interactions, blending social feeds with DeFi functionalities for a unified experience.

-

Tokenized Content and Creator Monetization: Systems such as Zora enable creators to tokenize digital content, making it tradable and providing direct revenue streams through creator coins and NFTs.

-

Decentralized Community Governance: Tools like CharmVerse empower DAOs and token communities with on-chain voting, role management, and bounty rewards, fostering active and transparent participation.

-

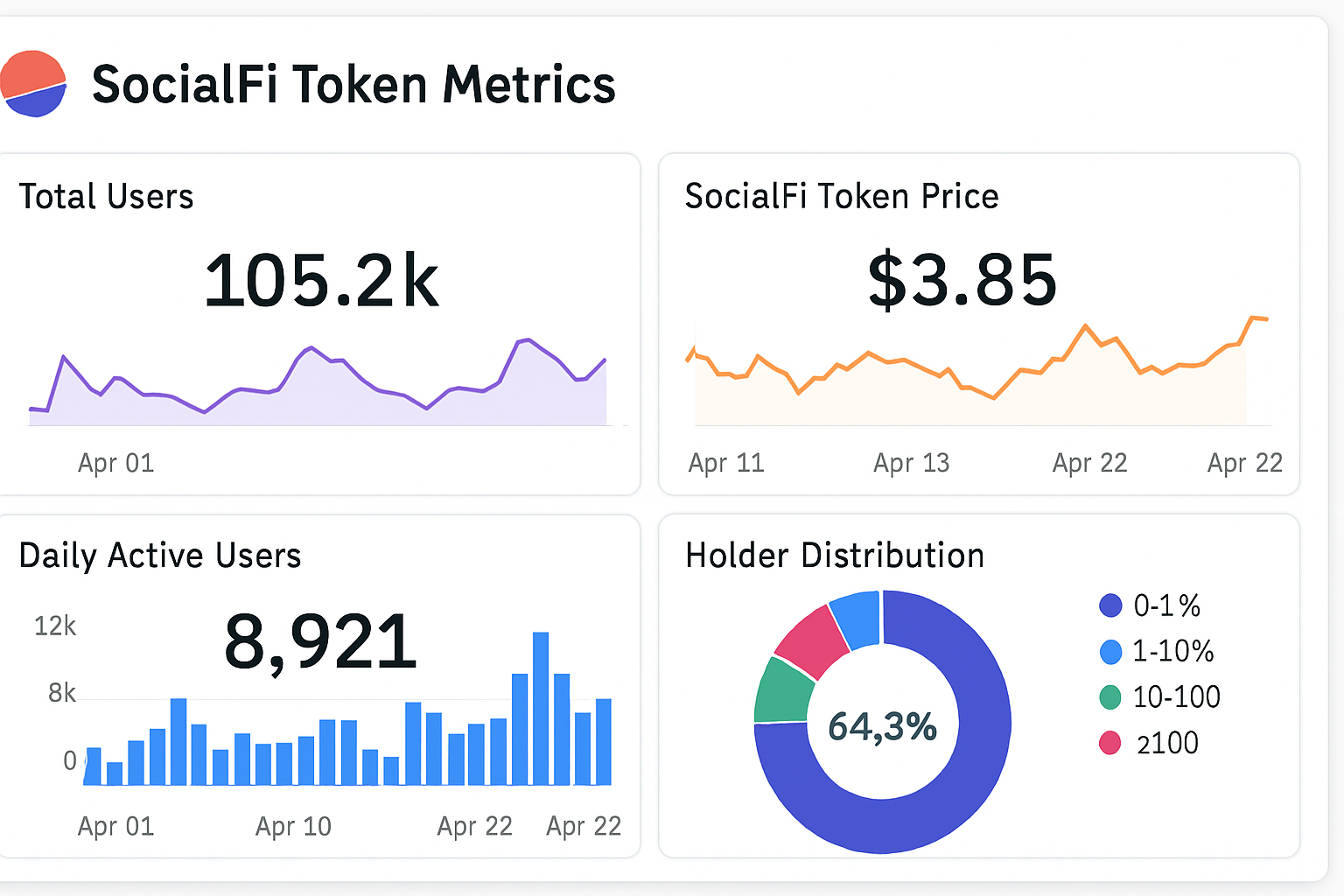

Real-Time Analytics and Transparent Reward Systems: SocialFi-DeFi apps increasingly offer live dashboards and transparent metrics, as seen with CoinGecko and Dune Analytics, allowing users to track token performance and community engagement.

If Charm App does emerge as described in speculation, seamlessly integrating social rewards with DeFi mechanisms on Base, it would need to address several critical factors:

- User-friendly onboarding: Lowering technical barriers while maintaining decentralization

- Sustainable reward structures: Avoiding unsustainable APYs that lead to capital flight

- Transparent governance: Empowering communities through fair voting powered by native tokens like $CHARM

$CHARM Token Use Cases: Hype vs Reality?

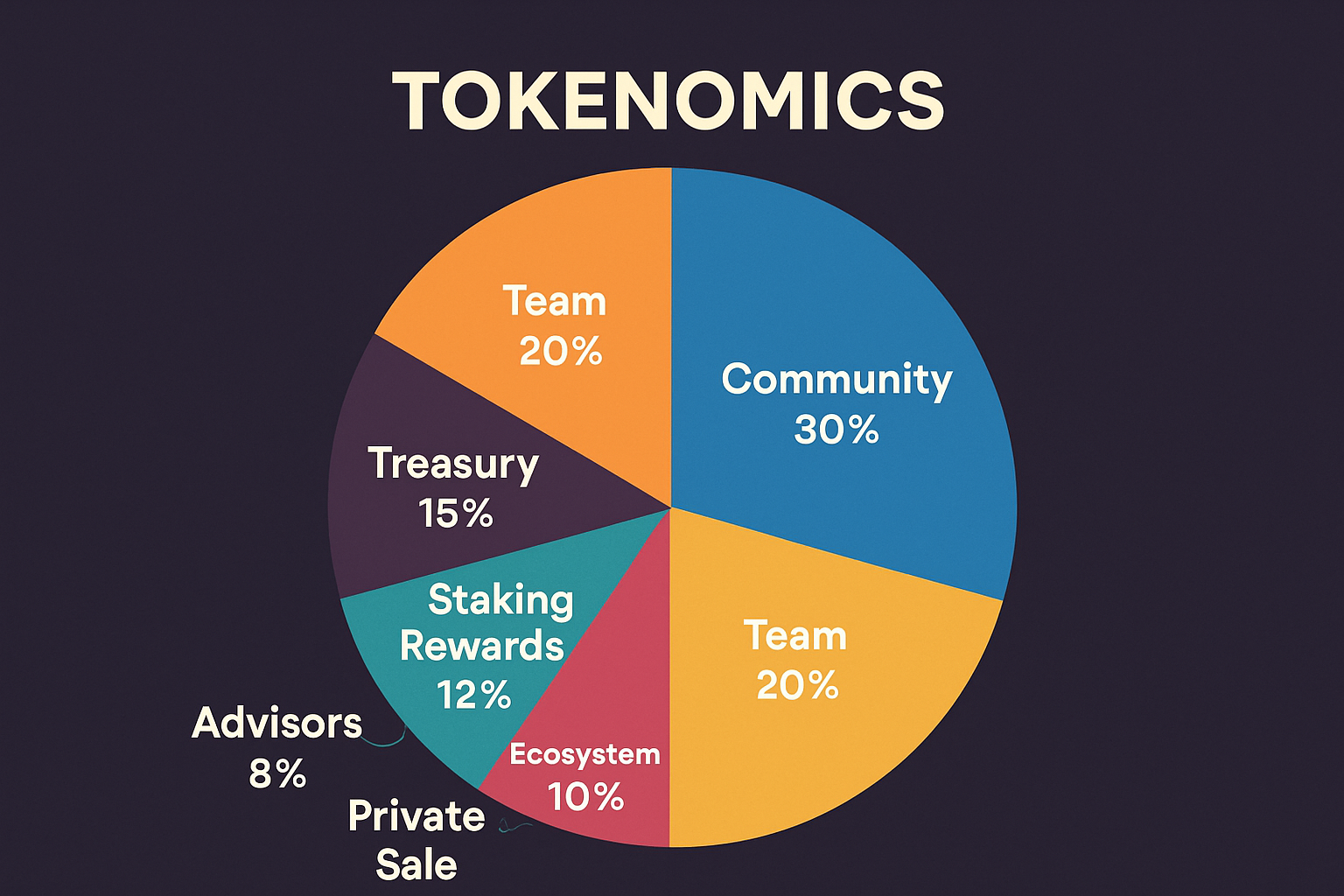

The absence of an official $CHARM price or listing makes it impossible to analyze real-world utility or market performance at this time. For reference, other platforms have achieved remarkable APYs (as highlighted by @CharmFinance), but these returns often come with significant risks and volatility. Any future launch should prioritize clarity around emission schedules, staking mechanics, and governance rights to avoid the pitfalls seen elsewhere in DeFi.

Speculation around the $CHARM token’s use cases typically mirrors broader SocialFi trends: staking for governance, earning rewards through content creation, and liquidity mining. But without a live product or transparent roadmap, these remain aspirational. If and when Charm App launches on Base, it will need to differentiate itself from established players by offering genuinely novel mechanisms for value accrual and community empowerment. Otherwise, it risks being lost in a crowded field of lookalike projects.

What Early Adopters Should Watch For: Red Flags and Green Lights

For crypto enthusiasts eyeing the next big SocialFi play on Base, caution is warranted. Here are some signals that could separate a legitimate Charm App launch from vaporware:

Key Warning Signs & Positive Indicators for SocialFi-DeFi App Launches

-

Transparent Team & Backers: A credible SocialFi-DeFi app launch features a public, verifiable team with reputable backers or investors. Lack of transparency or anonymous founders is a major red flag.

-

Audited Smart Contracts: Reputable projects like Charm AI and Friend.tech undergo independent smart contract audits. Absence of published audits increases the risk of vulnerabilities and exploits.

-

Transparent Roadmap & Regular Updates: Legitimate apps publish roadmaps and development milestones with frequent progress updates. Projects with no clear timeline or irregular communication may lack direction or commitment.

-

Integration with Established Platforms: Integration or partnerships with well-known Base ecosystem apps (e.g., Zora, Farcaster, Friend.tech) adds credibility. Isolated projects with no ecosystem connections may face adoption challenges.

-

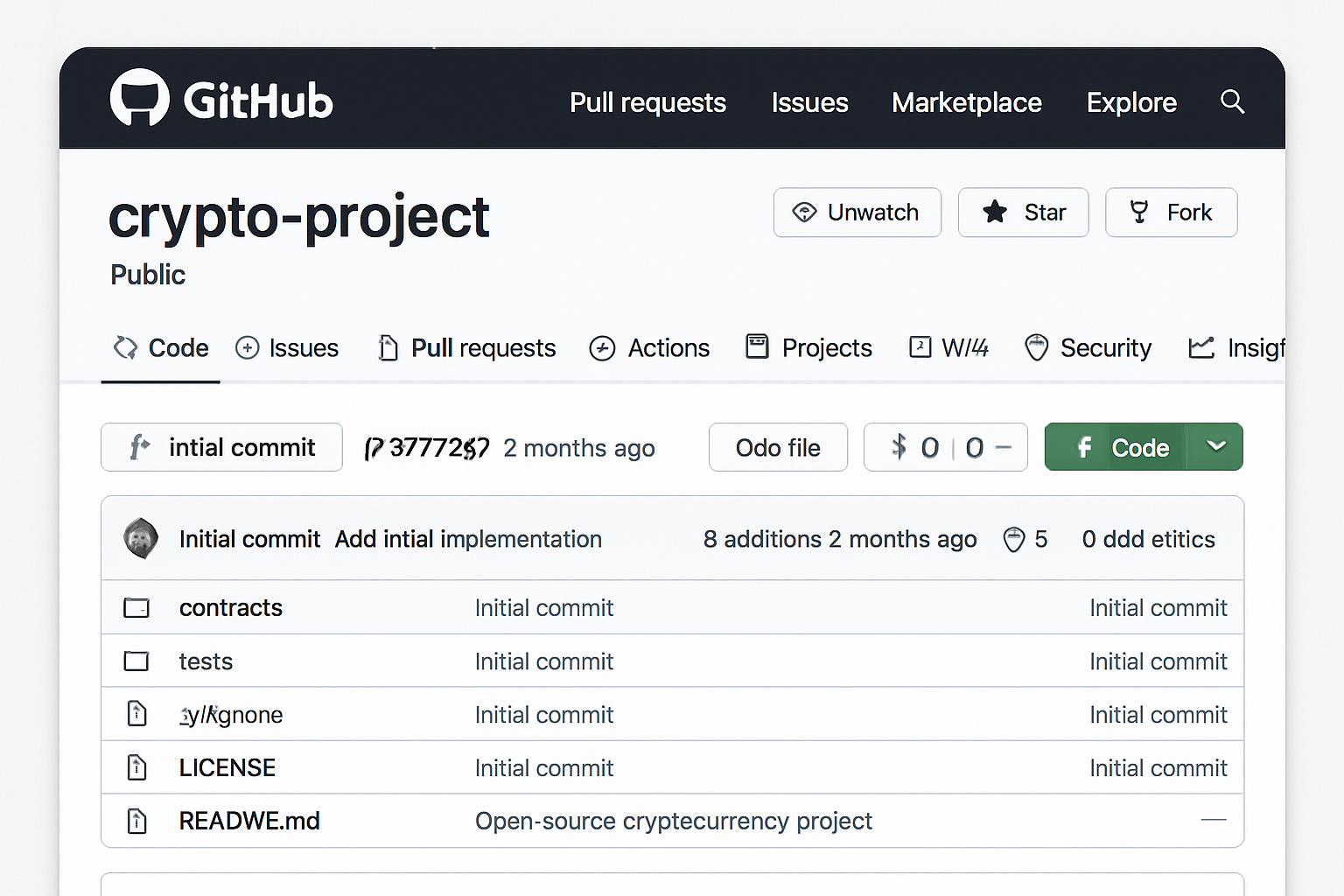

Open-Source Code Availability: Projects that open-source their code on platforms like GitHub foster community trust and peer review. Closed-source projects limit transparency and scrutiny.

-

Real-World Use Cases & Adoption: Positive indicators include demonstrated real-world utility and user adoption, as seen with Friend.tech turning social feeds into marketplaces. Lack of practical use cases may indicate hype-driven launches.

Transparency from the development team is non-negotiable. Look for open-source code repositories, regular community updates, and clear documentation. Any ambiguity around tokenomics or governance should be treated as a significant risk factor. Conversely, partnerships with reputable DAOs or integration with leading Base protocols would lend much-needed credibility.

How Charm App Could Fit Into the SocialFi Ecosystem

If Charm App materializes as a true hybrid platform, it could fill a unique niche by providing tools for both social engagement and decentralized finance under one roof. This would position it alongside – but distinct from – platforms like Farcaster, which prioritizes user-owned social graphs, and DeFi-first apps like Charm AMM.

The opportunity lies in bridging these worlds: enabling users to earn yield not just through trading or staking, but also by contributing to vibrant on-chain communities. Such synergy could accelerate adoption of both SocialFi and DeFi primitives on Base.

Final Thoughts: Navigating Hype Cycles Responsibly

As of October 20,2025, the “Charm App” remains an enigma in the context of SocialFi-DeFi convergence on Base blockchain. The absence of verifiable information about its existence or the $CHARM token underscores a broader truth: due diligence is paramount in this sector. With so many projects jockeying for attention – and capital – only those with real utility, transparency, and an active community will endure beyond initial hype cycles.

If you’re considering participating in any new decentralized social crypto app claiming to blend DeFi with social rewards via tokens like $CHARM, scrutinize every detail before committing funds or personal data. The promise of earning rewards is enticing but must be weighed against risks inherent in early-stage crypto experiments.

For now, keep an eye on official announcements from credible sources within the Base ecosystem and stay engaged with trusted review sites like Socialfi Apps as this intriguing intersection between social networks and decentralized finance continues to evolve.